Whether it’s the supply of vaccines or PPE or baking supplies and paper towels, COVID-19 has highlighted the weak links in our supply chains, which are often global or at least international. Indeed, the pandemic could be a catalyst for a complete rethink of what we manufacture and how we get it to market. Naturally, that would have a big impact on real estate markets, especially commercial real estate in Canada.

Early in the pandemic, grocery stores struggled to keep the shelves stocked with the basics we took for granted – from paper towels and toilet paper to flour and eggs. Shutdowns in production reduced the selection of canned soft drinks. Hand sanitizer demand prompted some breweries and distilleries to switch to manufacturing hand sanitizer, which could be packaged in plastic bottles, rather than the increasingly scarce aluminium cans. Today, the Canadian government awaits the delivery of internationally-produced COVID-19 vaccines.

Supply Challenges Highlighted by the Pandemic

Businesses need to connect their goods with consumers, be they other businesses who use these goods as inputs, or customers who use the goods themselves.

Now more than ever, it’s time to consider your supply chain – how you will acquire your inputs – as well as where you will manufacture your goods and how you will get them to your customers in a time and cost-efficient way. Gas prices, tariffs and highway congestion all add to costs. Rest assured, you’re not alone in this.

Companies large and small are rethinking how they will deliver products in a reliable and cost-effective manner. Globalization continues to be under scrutiny, and trade volumes are down markedly, as reflected in port and railroad data. As all of these phenomena collide, COVID-19 could be the catalyst for a complete rethink of supply chains as we know them.

While there has not been a complete breakdown in supply chains, the disruptions seen across a myriad of industries and regions have sparked a conversation into whether globalization, and the premise behind global trade flows, need to be rethought.

Any reconfiguration of existing supply chains would have a significant impact on North American industrial real estate markets. While the point-of-origin for many imported goods could shift, for example from Asia to Latin America, Eastern Europe or Africa, an equally seismic shift would be for manufacturing to be done on home soil. Returning manufacturing to North America could yield several benefits, including being closer to the end consumer, less risk in the transport of goods, and greater oversight and safety protocols.

Supply chain patterns would look very different if goods were produced domestically than if imported from another part of the world. It should be noted, however, that if these changes occur, it would be over a period of years — if not decades — and would vary considerably by industry. For example, auto production is a very complex and highly specialized process, so it is doubtful that it would be altered in any meaningful way. Apparel, on the other hand, could be more easily shifted to another country or, indeed, produced domestically.

Domestic Production Could Be the Solution

Governments are seeing the value of returning manufacturing to a domestic location. Canada has been relying on European production facilities for both Pfizer and Moderna vaccines, which have been delayed partially due to production limitations but which also have been affected by trade rules.

On Feb. 2, Prime Minister Justin Trudeau announced a tentative deal with U.S. vaccine-manufacturer Novavax to produce in Canada, at a new Montreal facility capable of making two million doses/month, a small percentage of the 52-million dose contract. Other domestic facilities are also coming online, notably University of Saskatchewan in 2022 and Precision NanoSystems in Vancouver in 2023.

For Canada, Ontario’s Greater Golden Horseshoe is the centre of economic activity and prosperity. The region generates 25 per cent of Canada’s GDP (source here). It is close to the American market and is home to an educated workforce.

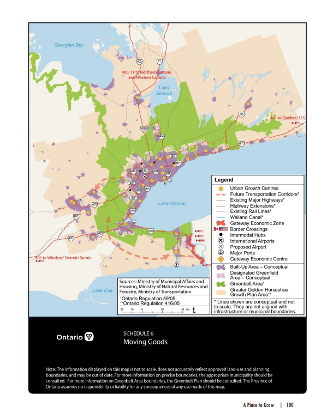

As the only urban growth centre north of the GTA, Barrie is the hub of the Simcoe region economy and one of the fastest growing cities in Canada. Smaller centres support the urban centre, which has easy Highway 400 access to the GTA as well as northbound out of Ontario, as the accompanying map from Ontario’s growth plan shows. An airport with 24/7 customs service is a short drive out of town and there is also a small regional railway that serves industrial areas in Essa, Innisfil and Barrie.

Barrie real estate is clearly a good option to consider for investors and businesses looking to lease commercial property, with its many transportation and economic links. The area’s growing workforce is young and educated, which has only been increasing in recent years as young professionals flee Toronto to settle in Barrie, which offers more value for money in residential real estate.

As SIOR and CCIM specialists, we at Squarefoot Commercial Group can help you find the best location for you to grow your business. Specializing in commercial real estate in the Simcoe County region, we have the experience and market expertise to help you achieve your short- and long-term goals. Contact Squarefoot today!

Reader Interactions